Nonco and OpenTrade Partner to Launch End-to-End Stablecoin Yield Infrastructure for FinTechs

Emmanuel Mugabo

Jun 12, 2025

Nonco, a leading institutional digital asset trading firm specializing in providing stablecoin liquidity, and OpenTrade, an institutional stablecoin ‘yield-as-a-service’ platform, have partnered to provide companies with a full spectrum of stablecoin infrastructure services like local currency to stablecoin on/off ramps combined with real-world asset backed stablecoin yield, all delivered in a way that eliminates the complexities of trying to manage these operations in-house, lowers costs, and opens new revenue streams.

“Stablecoins are the backbone of modern digital finance, especially in emerging markets where access to dollars and yield is often limited. By partnering with OpenTrade, we’re making it radically easier for our counterparts to access meaningful financial products — dollars, yield, and seamless local on/off ramps without having to build and manage the infrastructure themselves. — Fernando Martínez, CEO at Nonco.

Nonco is a digital asset trading firm built for institutional counterparties. Led by a team with over a decade of experience in crypto, Nonco takes a risk-managed, noncustodial approach to trading. The firm leverages smart contracts, bilateral infrastructure, and clearing-based capabilities to provide liquidity across stablecoins, legacy assets, and altcoins. Today, Nonco is among the largest liquidity providers in the space, servicing centralised and decentralised exchanges, as well as tier-1 OTC counterparties.

About OpenTrade

OpenTrade is an institutional-grade platform for real-world asset-backed USDC & EURC yield products. Backed by leading investors including a16z Crypto and Circle, OpenTrade’s enterprise-grade platform has been purpose-built to provide FinTechs with an out-of-the-box solution that allows them to power USDC and EURC yield products for their users, accessible with the click of a button, and secured through OpenTrade’s bankruptcy-remote structure, bank-grade operations, and time-tested legal framework.

Unlike many tokenized RWA projects that primarily serve institutional clients, OpenTrade has pioneered a B2B2C “yield-as-a-service” model that enables financial platforms to embed RWA-backed yields directly into their existing user experiences. This includes some of the leading NeoBank and exchange apps in LatAm like Belo, BuenBit, and Littio, who use OpenTrade to power 3–9% APR returns on USD and EUR for over 5 million users (across Argentina, Colombia, Mexico, Peru, and Spain) who are able to access these it with just a few clicks in their apps.

This approach has proven particularly powerful in regions where traditional financial infrastructure has left significant gaps in terms of both USD/EUR access and effective means to save and generate wealth in these currencies. For people living in countries where inflation has been a persistent challenge, these aren’t just incremental improvements; they represent a fundamental shift in what is financially possible for them.

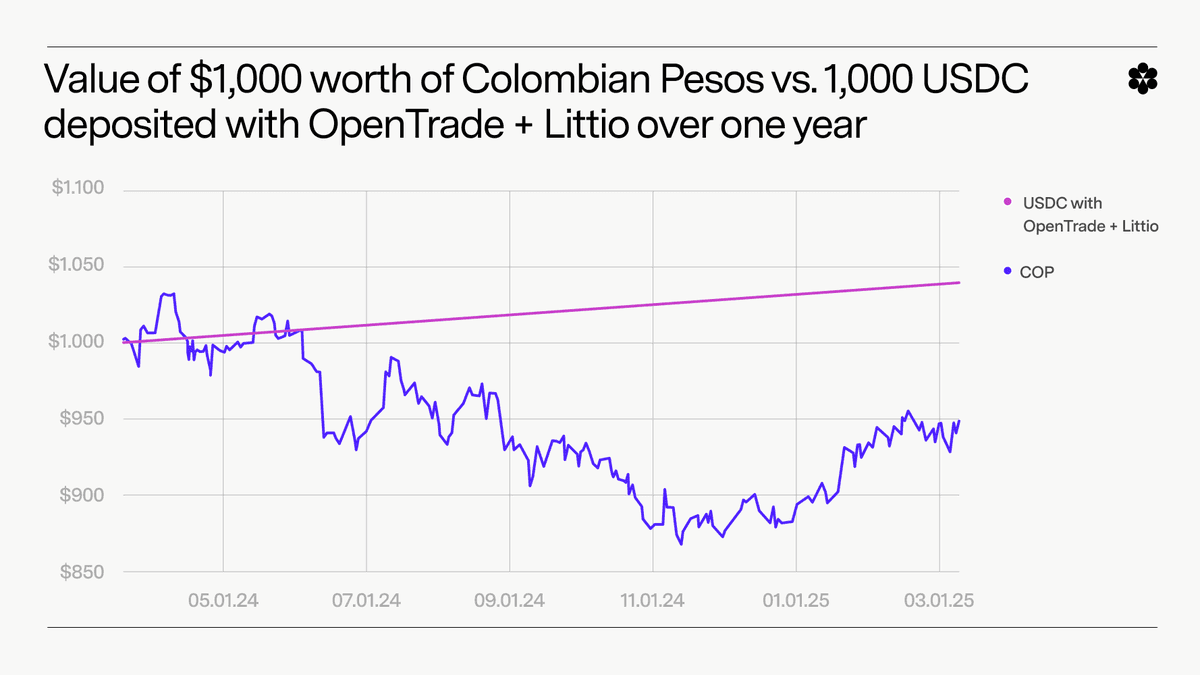

The chart below illustrates the difference in performance between $1,000 held in Colombian Pesos versus $1,000 deposited in USDC through OpenTrade and Littio over the past year. While the value of COP fluctuated significantly, dropping below $900 at its lowest, users holding USDC through the OpenTrade and Littio partnership saw steady appreciation, driven by yield-generating real-world assets.

This contrast highlights the tangible benefits of OpenTrade’s yield-as-a-service model in inflation-prone markets. For users in Colombia, the ability to seamlessly convert local currency into USDC and earn stable returns offers not just protection against volatility but a fundamentally better way to save and grow wealth.

This is exactly the kind of impact Nonco and OpenTrade aim to scale through their joint infrastructure that offers fintechs the tools to deliver real financial value to users with minimal friction and maximum trust.

“Traditional banks in Colombia offer a maximum of 0.4% APR on dollar accounts, that is if you can even qualify for one,” explained Jeff Handler, OpenTrade’s Chief Commercial Officer. “Through our partnership with Littio, users can now earn up to 6% APR on USDC balances without complex onboarding requirements or hidden fees. It’s financial access reimagined from the ground up.”

A Full-Stack Stablecoin Solution Offered by Nonco and OpenTrade

Together, Nonco and OpenTrade now offer companies like NeoBanks, exchanges, FinTech, and an increasingly broader set of businesses and enterprises with truly the full spectrum of enterprise-grade stablecoin services.

The combined solution offers:

Local currency, such as Peso, bolívar, and Real, to stablecoins like USDC/USDT on/off ramps

Embedded, high-quality dollar-denominated RWA-backed stablecoin yields

Streamlined compliance, operations, and user experience

Lower cost and faster time-to-market versus building in-house

Nonco and OpenTrade help companies avoid the high costs, complexity, and time it would take to build these capabilities in-house. Instead, they gain a single, integrated solution that makes it easier and cheaper to launch, manage, and scale stablecoin-backed offerings, which unlocks new revenue streams and delivers more value to users.

Emmanuel Mugabo

Jun 12, 2025