Remittances: How Stablecoins are Transforming Latin America’s Financial Future

Emmanuel Mugabo

May 7, 2025

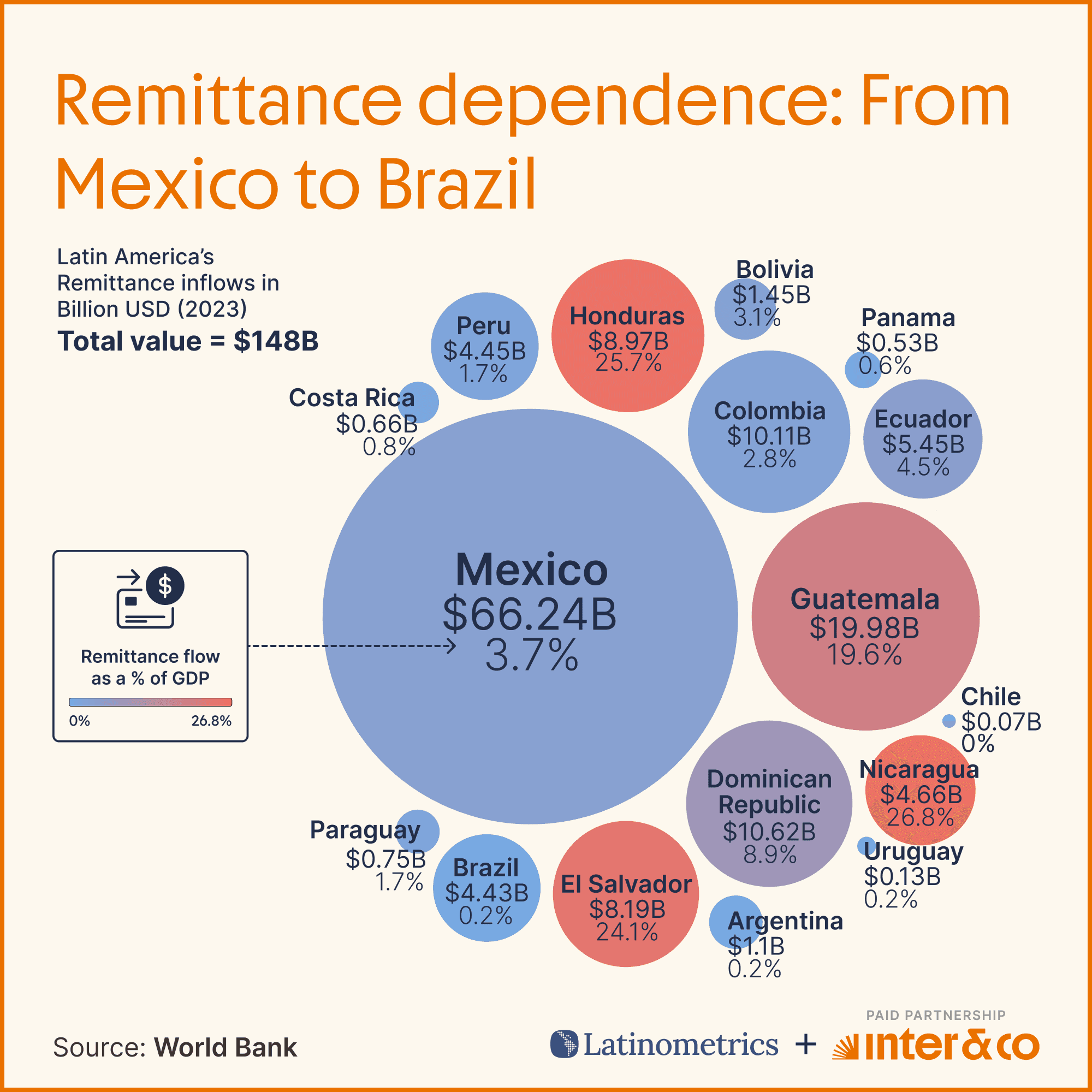

In 2024, personal remittances sent by Latin Americans from abroad accounted for 2.9% of Latin America’s GDP, reaching $161bn of dollars sent to the continent. These remittances can be quite significant for individual countries like Nicaragua, Guatemala, and El Salvador, where they account for 19 to 26% of their GDP.

Latin Americans earning dollars from abroad frequently send a portion of their earnings back to Latin America to cover basic living expenses and ensure financial well being of their dependents. As such, fintechs within the region and in the United States have been developing solutions to address challenges with remittances. Now, with global adoption of stablecoins as a medium of exchange, new fintechs and neobanks are using on-chain payment rails to make remittances even cheaper and more direct.

These stablecoin-based solutions are transforming remittances with innovative new financial products that bridge the safety and security of traditional banking with the ease and accessibility of digital wallet experiences.

USD remittances are critically important for Latin American economies, with a number of countries relying on them for a major portion of their economy. These funds support millions of families, covering critical expenses such as education, healthcare, housing and basic living expenses, and often act as a buffer against economic instability, particularly with high inflation persisting over the past few years. However, traditional remittance systems impose high fees, sometimes as high as 5–10% per transaction, and can take days to process, while many recipients lack access to formal banking services. The shortcomings of the current financial systems for Latin Americans highlight the urgent need for innovative solutions.

The Opportunity for Stablecoin Fintechs

Leading fintechs in Latin America are leveraging blockchain and stablecoin rails to deliver innovative remittance solutions, addressing the high fees, high minimum deposit requirements, and slow processing times of traditional banking systems. For instance, Felix Pago, a WhatsApp-based remittance platform, raised $75 million to expand its services across Colombia, Ecuador, and Peru, having already processed over $1 billion in 2024. Similarly, Circle’s Payments Network, launched with partners like BCB Group, Coins.ph, Conduit, and Flutterwave aims to streamline fragmented cross-border payment systems, offering near-instant, low-cost transfers.

By reducing the 5–10% fees typical of legacy providers, these stablecoin solutions drive more funds to the region, enhancing financial well-being and enabling fintechs to capture a larger share of their customers’ banking experience through digital wallets.

Beyond remittances, fintechs can expand their offerings into savings products by partnering with platforms like OpenTrade, which enables fintechs to offer their users the ability to earn stable and predictable returns on stablecoins backed by real-world assets such as US money market funds and corporate bonds.

USD remittances are critically important for Latin American economies, with a number of countries relying on them for a major portion of their economy. These funds support millions of families, covering critical expenses such as education, healthcare, housing and basic living expenses, and often act as a buffer against economic instability, particularly with high inflation persisting over the past few years. However, traditional remittance systems impose high fees, sometimes as high as 5–10% per transaction, and can take days to process, while many recipients lack access to formal banking services. The shortcomings of the current financial systems for Latin Americans highlight the urgent need for innovative solutions.

The Opportunity for Stablecoin Fintechs

Leading fintechs in Latin America are leveraging blockchain and stablecoin rails to deliver innovative remittance solutions, addressing the high fees, high minimum deposit requirements, and slow processing times of traditional banking systems. For instance, Felix Pago, a WhatsApp-based remittance platform, raised $75 million to expand its services across Colombia, Ecuador, and Peru, having already processed over $1 billion in 2024. Similarly, Circle’s Payments Network, launched with partners like BCB Group, Coins.ph, Conduit, and Flutterwave aims to streamline fragmented cross-border payment systems, offering near-instant, low-cost transfers.

By reducing the 5–10% fees typical of legacy providers, these stablecoin solutions drive more funds to the region, enhancing financial well-being and enabling fintechs to capture a larger share of their customers’ banking experience through digital wallets.

Beyond remittances, fintechs can expand their offerings into savings products by partnering with platforms like OpenTrade, which enables fintechs to offer their users the ability to earn stable and predictable returns on stablecoins backed by real-world assets such as US money market funds and corporate bonds.

Next Generation Fintechs

The next generation of fintechs in Latin America built on stablecoin rails is revolutionizing the banking experience by cutting fees, making money move at the speed of an email, and empowering millions to access USD-denominated financial products. By addressing the challenges of traditional systems and offering protection against local currency volatility, these platforms are building a foundation for financial stability and inclusion to the global financial economy.

The integration of yield products marks the next frontier, enabling users to grow their savings from their remitted funds and experience financial mobility with digital wallets and stablecoin accounts. Fintechs have a unique opportunity to innovate, expand their offerings, and create a comprehensive financial ecosystem that uplifts communities across the region.

Emmanuel Mugabo

May 7, 2025