Company

Buenbit is a leading Latin American crypto exchange and financial services platform that transforms complex technologies into simple financial tools, empowering users to protect and grow their savings in volatile economies.

Founded in 2018, Buenbit was built to offer users in Argentina, and now across LatAm with a simple way access to cryptocurrencies and USD stablecoins accounts with local currencies. Over the years, BuenBit has grown to serve over 800,000 users, and continues to offer new and innovative products including Crypto‑yield or savings programs which allow users to earn daily interest on USDC/USDT with no lock‑up periods or hidden fees.

Headquarters

LatAm

Industry

Exchanges

Products used

USDC Yield

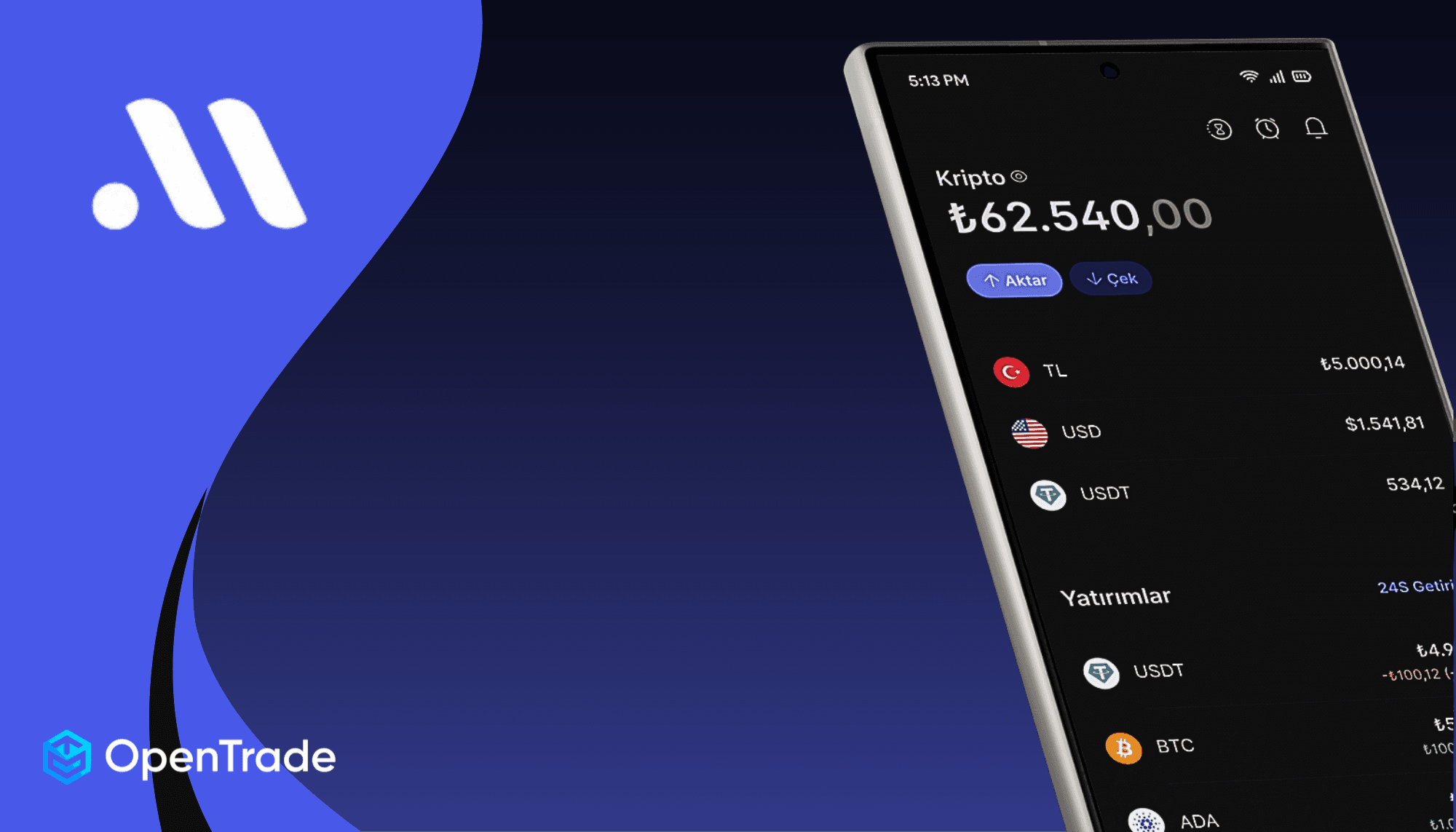

Buenbit has partnered with OpenTrade to integrate institutional-grade real-world asset (RWA) backed yield products directly into its platform. Adding RWA-backed returns from products like OpenTrade’s Money Market Fund Yield vault, complements Buenbit’s existing DeFi and Crypto backed yield options, while allowing them to maintain their operations in USDC / USDT with their existing wallets, systems and processes.

Exchanges operating in Latin America have seen a surge in demand for USD stablecoins like USDC / USDT and, and reliable ways to generate low risk returns on these stablecoins. While this presents an opportunity, sole reliance on many of the available yield options in DeFi / Crypto comes with risk management and operational challenges that make it difficult to appropriately manage corporate treasuries and end user facing yield offerings..

Outside of DeFi, onboarding and working directly with financial institutions like banks to access RWA returns comes with its own challenges including lengthy onboarding processes and added costs and operational complexities that work to effectively off-set the potential benefits.

These challenges made it hard to launch a yield product that was simple for users, scalable for the business, and safe from a legal and operational standpoint until they partnered with OpenTrade.

“At Buenbit, our goal is to become the most complete investment app in Latin America — a platform where users can access the best opportunities to grow their money. One of the most effective ways we offer is helping people generate yield through stablecoins. In a context where inflation affects not only Latin American economies but also the U.S. dollar itself, earning interest in stable assets becomes a powerful tool to protect and grow wealth. Thanks to our integration with OpenTrade, we’re able to deliver those yields seamlessly. With just one tap in the app, users can put their money to work — easily, transparently, and without friction.”

Federico Ogue

CEO of Buenbit

As one of Latin America’s leading crypto-fintech platforms, Buenbit required a scalable, enterprise-grade treasury management solution that could allow them to reliably help everyday users preserve and grow their savings in USD without friction, volatility, while trusting that their funds are always completely secured.

To meet this need, Buenbit required an institutional-grade platform that:

Generates stable returns on USDC through real-world asset-backed lending

Integrates natively into Buenbit’s app and backend

Provides full transparency and legal clarity

Supports cross-border treasury management, enabling Buenbit to efficiently deploy stablecoin balances across markets while keeping spreads and fees low for users

Maintains bank-grade asset management and operational standards

Product options that allow Buenbit to generate returns without lockups or transaction fees to facilitate in and outflows in line with end user activity

Reduces operational overhead by allowing Buenbit to connect using its existing wallets, and maintain its existing treasury management and reporting systems and processes

As a trusted platform for over 800,000 users, Buenbit couldn’t compromise on these key requirements when selecting a partner that could help them unlock the full potential of unprecedented access to digital dollars and dollar savings for everyday people of LatAm

Ability to generate stable and predictable returns of 4 - 7%+ APR from a suite of real-world asset backed yield product options

Trust in OpenTrade’s bank-grade off-chain operations with underlying assets fully secured in a bankruptcy remote structure

Interest accrues instantly and compounds daily with no transaction fees to move funds in and out, which allows Buenbit to dynamically and flexibly maintain its positions in yield products vs. USDC / USDT

OpenTrade enabled Buenbit to generate RWA-backed yield on USDC and USDT, and offer new yield products for its users. With this partnership, Buenbit can efficiently manage their treasury across both DeFi and RWA-backed sources of yield generation with their existing wallets and treasury management systems without ever needing to off-ramp USDC and USDT into USD.