Company

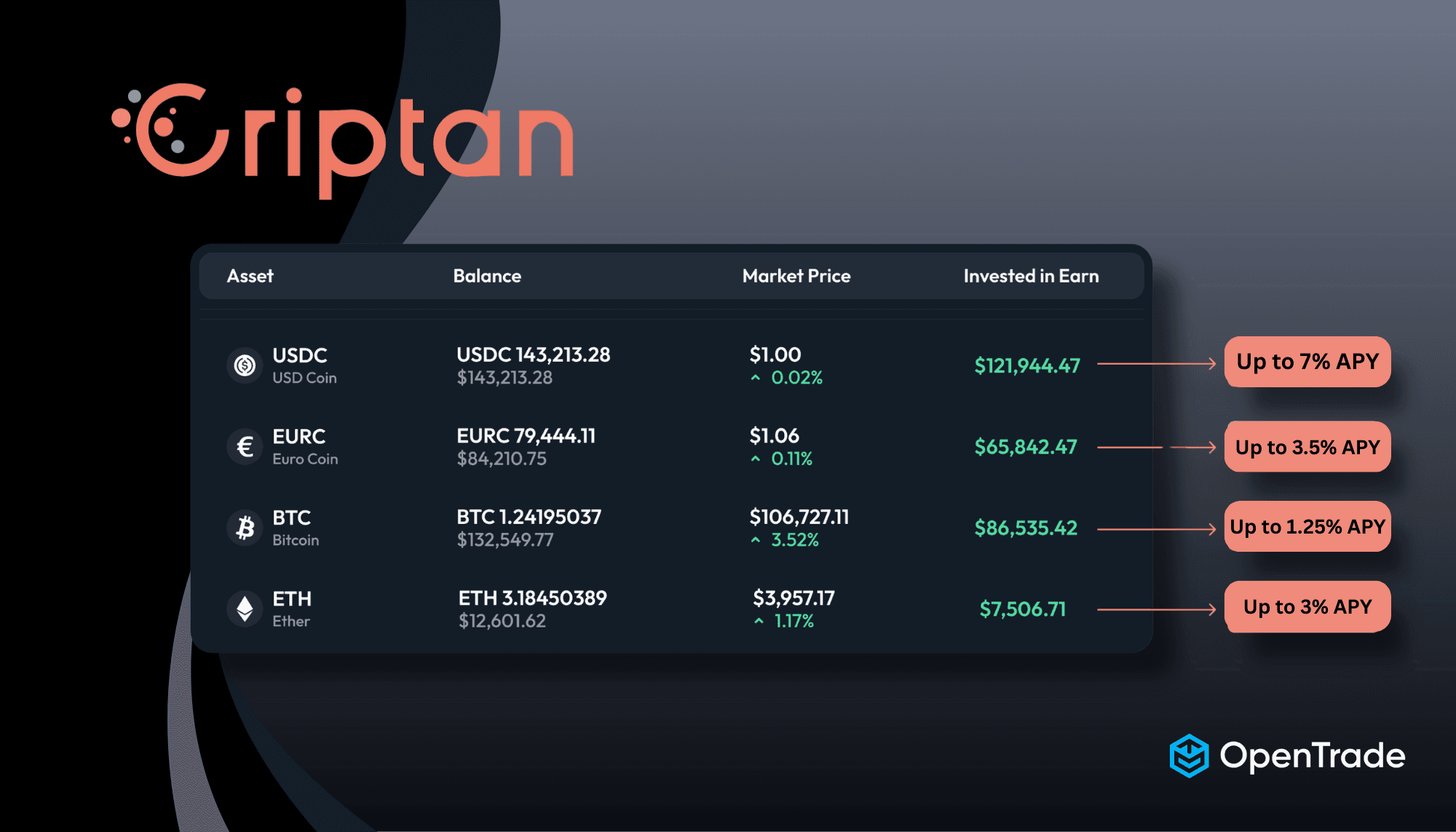

Criptan is a Spanish fintech which provides businesses and individual users with simple, secure access to digital assets like BTC/ETH and stablecoin (USDC/EURC) accounts with savings and investment options. Criptan manages over €50 million in client assets, and aims to protect clients' wealth while helping them grow it, based on high standards of security and transparency.

Headquarters

EUR

Industry

Neobanks & Fintechs

Products used

USDC / EURC Yield

Criptan partnered with OpenTrade to help power their Criptan Earn product, generating stable RWA-backed yield, enabling clients to earn predictable passive income on their stablecoin earnings.

In countries like Spain, where retail banking products often come with high fees and low yields, savers are left with few options to grow their wealth without taking on unnecessary risk. Criptan’s users, from freelancers to small business owners, were looking for a better way to grow their savings. They needed simple, secure euro and dollar-based yield options that offered higher returns than local banks, without the risks or complexity of DeFi and crypto staking.

At the same time, Criptan faced operational hurdles. European financial regulations are becoming increasingly strict around digital assets, requiring platforms to provide full transparency and ensure proper custody and reporting to meet MiCAstandards. Criptan had to navigate these challenges while also managing cross-currency flows, maintaining liquidity, and delivering a seamless user experience.

“Our mission at Criptan has always been to democratize access to the benefits of digital finance in a secure and transparent way. Partnering with OpenTrade allows us to take a significant step forward, bringing institutional-grade investment opportunities to everyday users while maintaining the simplicity and trust that define our platform. We believe this alliance strengthens our value proposition and reinforces our commitment to building the future of finance in Europe”

Jorge Soriano

CEO & Co-Founder of Criptan

Criptan was built to make digital assets simple, secure, and rewarding for everyday Europeans. Their users from individual savers to small businesses trusted the platform to buy, sell, and store crypto with ease and low fees.

But as inflation persisted and traditional banks continued to offer near-zero returns, users wanted more than just access to crypto; they wanted their money to work for them. They were looking for a safe, automated way to grow their savings in euros or dollars, without the complexity of manual trading or the risks of volatile DeFi products.

To meet this growing demand, and to diversify away from yield sources correlated with the crypto markets, Criptan needed a compliant, real-world asset-backed yield solution that could deliver stable, transparent returns and integrate seamlessly with its existing wallet and portfolio features.

Stable, predictable returns backed by a suite of high quality financial assets

Interest accrues instantly and compounds daily

Freedom to move in and out of the OpenTrade yield products at will, with no terms or minimums

With OpenTrade products, Criptan can generate high risk-adjusted digital dollar- and euro-denominated returns that are not correlated with the crypto markets and do not require them to off-ramp into fiat. With no minimum deposits and no lock-up periods, Criptan can efficiently manage user deposits and withdrawals across their sources of yield generation.

Join leading platforms like Criptan that are transforming idle stablecoin balances into secure, yield-generating assets without compromising on compliance and transparency.

See a personalised demo to see how OpenTrade can help your exchange or fintech platform launch real-world asset-backed yield products in weeks, not months.