Company

Littio is a YC and Circle-backed neobank that allows users across Colombia to simply and securely convert pesos into dollars and euros, which they can save, transfer, and spend using a Littio debit card.

With high demand for U.S. Dollars and Euros and limited access for most Colombians, Littio has leveraged stablecoins combined with their easy-to-use, entirely digital platform to address this gap with a product that makes accessing, saving and conducting payments with USD and Euros simple, secure, and accessible to users with as little as $1.

Headquarters

LatAm

Industry

Neobanks & Fintechs

Products used

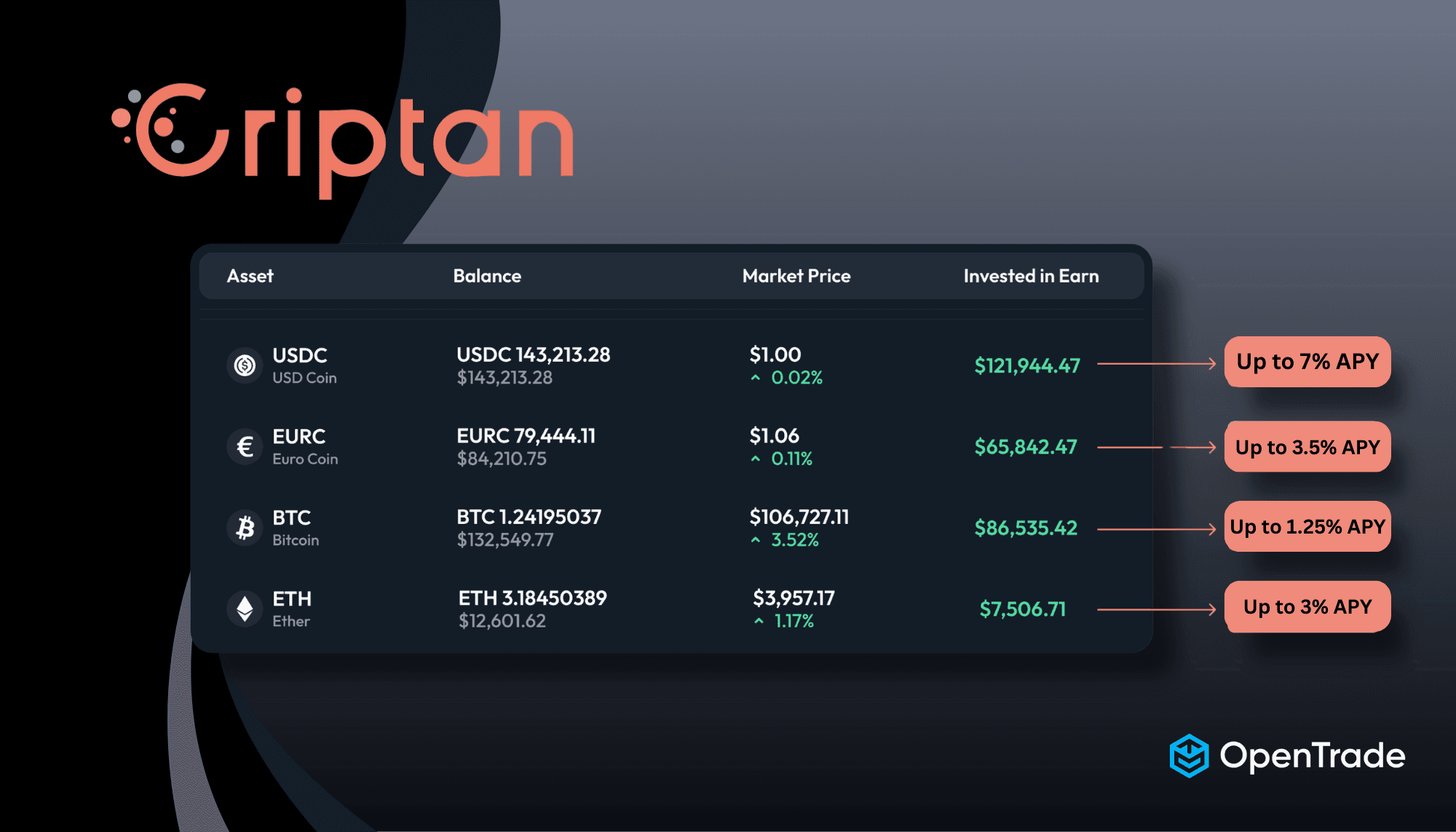

USDC / EURC Yield

Through Littio's partnership with OpenTrade, Littio can directly invest USDC, and now EURC from their segregated, Littio-custodied wallet into yield-generating tokenized assets via OpenTrade. Clients can earn competitive money market returns on idle balances while enjoying the flexibility to move capital quickly and easily through Littio's app

By leveraging USDC and EURC stablecoins, Littio's end-to-end solution enables individuals in Latin America to access stable and secure banking solutions through a dollar and euro bank account through their mobile app.

By working with OpenTrade, Littio is leveraging USDC, and EURC for custody, which means we are securely storing users' holdings. This includes:

Liquidity and Minting: Littio is using USDC for liquidity and minting, which involves creating or redeeming USDC as needed and converting between USDC/EURC and USD/EURO.

Treasury Management: Littio is using USDC for treasury management for company funds, which involves managing corporate and working capital funds within Littio’s ecosystem and treasury product.

In regions like Latin America, macroeconomic instability continues to erode personal savings and limit access to traditional financial tools where double-digit interest rates, high inflation, and currency devaluation drive investors towards assets with stable returns. In 2022, Latin America accounted for 9.1% of the global crypto value, reaching $562 billion between July 2021 and June 2022. The 40% growth in adoption is a clear indicator of the region's increasing interest in digital assets.

With high demand for and limited access to USD accounts within the traditional banking sector for most Colombians, Littio has leveraged USDC to address this gap through with a product that has made USD accessible for over 80,000 users (and growing) across the country.

In addition to limited USD access, it is nearly impossible today for the average Colombian to access USD wealth management products or even interest bearing USD accounts. Moreover, it is equally difficult for companies like Littio to access the accounts with with financial institutions like banks that are necessary to access the types of USD-denominated investment products that could be leveraged for end user facing wealth management / savings options.

As a newer Financial Technology company based outside of the U.S., this comes with its own challenges including lengthy onboarding processes and added costs and operational complexities that work to effectively off-set the potential benefits.

These constraints made it hard for Littio to offer a truly accessible, compliant, and low-risk way to offer their users to earn interest on the USD and EUR accounts until they partnered with OpenTrade.

While platforms like Littio are already helping users convert pesos into USDC and EURC to preserve value, most of those balances remain idle and do not generate any interest. As one of Colombia’s fastest-growing neobanks, Littio required a scalable, institutional-grade solution that could allow it to generate stable, low risk, predictable returns on its USDC and EURC treasury, and power products of its users that allow them to earn interest on their account balances.

To meet this need, Littio was looking for a platform that could:

Allow them to generate stable, predictable returns on USDC and EURC fully backed by high quality, ‘real-world’ financial assets such as sovereign debt instruments and money market funds s.

Streamline treasury operations and integrate directly into Littio’s existing user experience and backend infrastructure, with no need to off-ramp or change core systems

Maintain bank-grade asset management and operational standards

Provide strong legal protections as part of a bankruptcy remote structure that could ensure that Littio’s funds are always fully secured

Product options that allow Littio to generate yield without lockups or transaction fees to facilitate in and outflows in line with end user activity

Fully embedded in the Littio app, and accessible to users with the click of a button

Trust in OpenTrade’s bank-grade off-chain operations with underlying assets secured in a bankruptcy remote structure

Stable predictable USD-denominated returns, backed by high quality financial assets like U.S. Treasury Bills

With digital dollar Pots powered by OpenTrade, Littio is able to generate stable real-world asset returns on its USDC and EURC, and provide its users with unprecedented dollar and euro accounts that earn them up to 6% APR on their balances.

With Littio, earning interest on dollars and euros has never been simpler for users across Colombia, who can begin earning on their balances with a few clicks of a button in their Littio app. The combination of seamless access, and interest rates has already become a lifeline for individuals and families who would simply not be able to access these types of low-risk, stable returns anywhere in the traditional banking sector.

Join leading platforms like Littio that are transforming idle stablecoin balances into secure, yield-generating assets without compromising on compliance and transparency.

See a personalised demo to see how OpenTrade can help your exchange or fintech platform launch real-world asset-backed yield products in weeks, not months.